Will IPL media rights cross the billion-dollar mark?

A ready reckoner ahead of the media rights auction on September 4, where 24 companies could be in the fray as bidders

Nagraj Gollapudi

02-Sep-2017

ESPNcricinfo Ltd

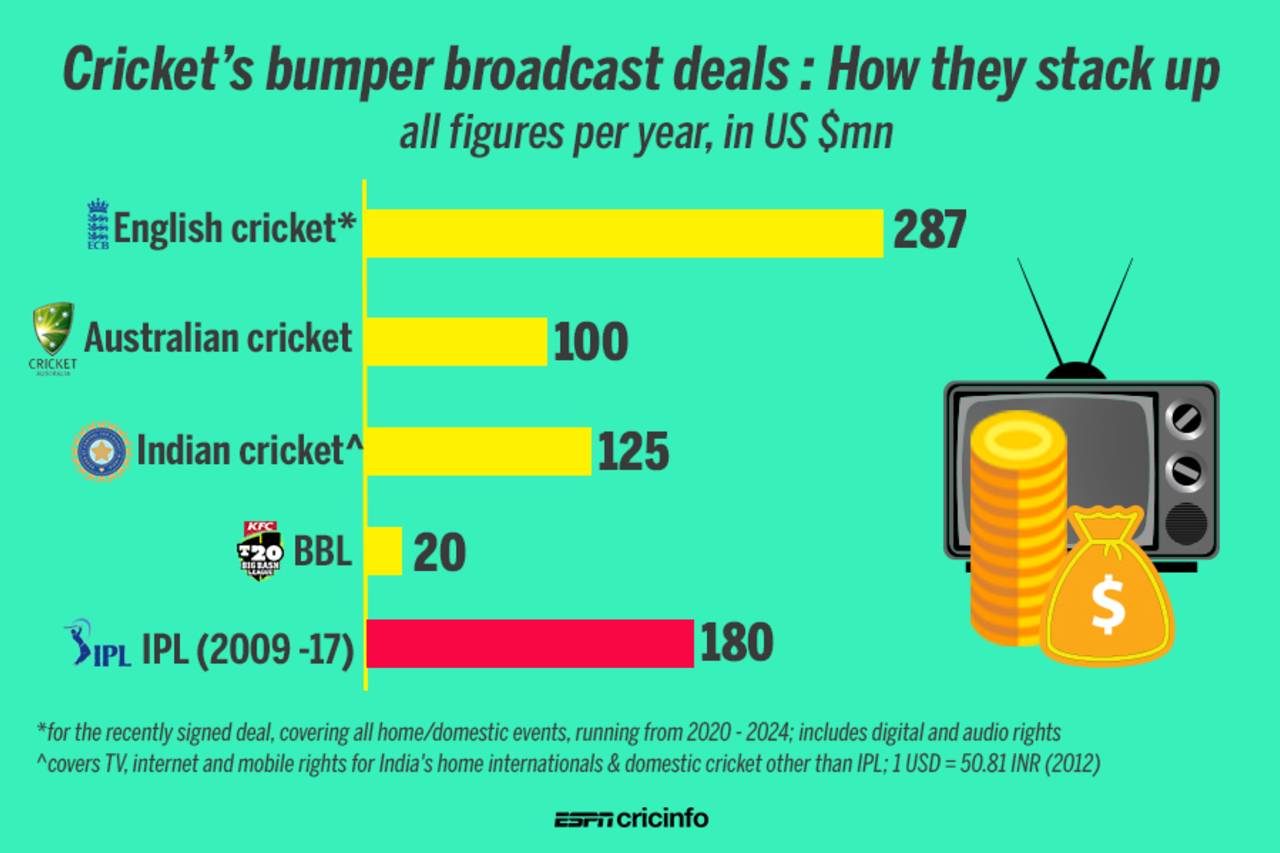

Is the Indian Premier League the most lucrative property in global cricket?

The answer will be revealed on September 4 when the BCCI conducts the auction for the IPL media rights. The bidding will take place in Mumbai, with some of the biggest names in global business set to vie for various rights of a tournament that has already realigned the boundaries of cricket in unpredictable ways during its ten years of existence.

Here is a ready reckoner to the bidding process, the bidders and the different rights being auctioned.

How many bidders are there?

A total of 24 bidders bought the bid document, including Facebook, Amazon, Twitter, Yahoo, Reliance Jio, Star India, Sony Pictures, Discovery, Sky, British Telecom and ESPN Digital Media.

The growth of the league can be measured through the diversity of the bidders as well as the number of companies that have shown interest. In 2008, when the IPL was conceived, about six companies bought the bid document for the first rights cycle. All were television entities and, eventually, only two qualified for the bid - the Sony-World Sports Group alliance and Nimbus.

How many categories of rights will be auctioned on Monday?

Previously, the BCCI, which owns the IPL, had sold the rights only for three categories: India television rights, India digital rights and rest of the world. However, on Monday, a set of seven rights will be open for bidding. For the Indian market, bids are divided into television and digital; then there will be separate bids for the USA, Europe, Middle East, Africa regions and the rest of the world. For these five markets, the bids include both television and digital rights.

How will the bidding process work?

The rights will be awarded to the highest bidder in each category. An interested party or a consortium can even make a global bid (for all seven categories) - if their bid is the highest, they will earn the rights.

The winner in each category will be determined by matching the bids which will be presented in a sealed envelope. In May, the BCCI had decided to retain the tender process which it said was the most transparent way to award the rights as opposed to e-auction. Recently the Supreme Court, too, struck down a petition favoring the e-auction. The BCCI was against the e-auction mainly because of the danger of bidders walking out once they realised they had reached their limit with the bid figures being publicly displayed. In a tender process, the bidder just gets one chance and has to commit to a figure they can put in the envelope.

What is the duration of the rights?

All rights have a five-year span: 2018-2022.

Why a five-year cycle, considering the previous television rights were for 10 years?

According to Rahul Johri, the BCCI's chief executive officer, 10 years is "too long" a period to commit in an industry that is dynamic. Previously, when the BCCI sold the television rights for 10 years, the IPL had not yet established itself. "It was a new property and it needed a long-term commitment," Johri said. "But now the world is changing so fast, so from both the rights seller's point of view and rights buyer's point of view, five years is a good term. A lot of companies do a five-year plan. So it is a more realistic way to go."

ESPNcricinfo Ltd

Which category could attract the most competition?

In the Indian market, television rights will remain the prime target as it is the "most valuable" property. In 2008, WSG bagged the television rights for the Indian market for a 10-year cycle (2008-2017) for $918 million. A year later, Sony bought those rights for $1.63 billion.

What is the likely worth of television rights in the Indian subcontinent?

Johri will not speculate, but is optimistic the number could be quite high considering the BCCI recently sold the India team sponsorship rights and the IPL title sponsorship for large sums. Smartphone manufacturer OPPO Mobiles India bought the team sponsorship rights for a five-year period, beginning April 2017, for about $166 million, edging out Vivo, another mobile phone manufacturer. Vivo, however, trumped Oppo by retaining the IPL title sponsorship rights (2018-22) for approximately $341 million, a 454% increase over the price paid for the same rights in 2012. "The IPL is one of the most viewed properties in the world. The IPL is a disruptive property. When the IPL is on, the world watches only IPL," Johri said.

How fierce is the competition for digital rights likely to be?

An increasing number of viewers are turning to digital platforms for sports coverage. With Facebook, Amazon, Twitter, Discovery Sports, Yahoo and BAMTech (an American internet video provider) aiming to leverage this audience, there could be fierce bidding among them and local providers like Reliance Jio, Star India and Sony. Star India was the previous rights holders for digital rights globally, having paid close to INR 303 crore for a three-year period of 2015-17. These digital behemoths are challenging traditional broadcasters by venturing into sports broadcasting. Amazon recently won the UK rights for showcasing all the major Association of Tennis Professionals (ATP) tournaments while BAMTech has been streaming Major League Baseball for a few years now.

ESPNcricinfo is a wholly owned subsidiary of ESPN Inc, the world's leading multimedia sports entertainment company. ESPN has a long-term collaboration with Sony Pictures Networks (SPN) for the launch of SONYESPN-branded television channels and digital assets in India and the subcontinent

Nagraj Gollapudi is a senior assistant editor at ESPNcricinfo